The ESG reporting process is far more than just collecting data and ticking regulatory boxes (CSRD, GRI, ESRS…). It’s a task that requires precision, consistency, and forward planning. Along the way, mistakes often occur – mistakes that, while seemingly small, are far more common than most organisations care to admit. These errors don’t just delay the process; they can undermine the credibility of the report and the company’s strategic goals. Here are some of the key culprits:

1. Submitting data late

One of the most common and critical errors is delivering the data late. ESG data often needs input from multiple departments, suppliers, or regions, which can cause significant delays. This last-minute scramble often results in incomplete or lower-quality reports, as teams rush to meet deadlines.

2. Unclear ownership of data

Knowing exactly who is responsible for providing each piece of data is essential. All too often, organisations lose sight of the data trail: who submitted it, who validated it, or who should have been responsible in the first place. This lack of clarity undermines the report’s reliability and creates inconsistencies.

3. Inconsistent data formats

Another frequent issue is the absence of a standardised format for submitting data. Different departments may share information in various forms – spreadsheets, emails, PDFs – making consolidation a headache. Even when the data arrives, it’s often not in the expected format, which slows down the process even further.

4. Data inconsistencies

Manual data collection dramatically increases the likelihood of errors. A small calculation mistake, a typo, or a missed figure can create discrepancies that damage the report’s credibility. Manual processes often turn the simple task of “making the numbers add up” into a draining and frustrating challenge.

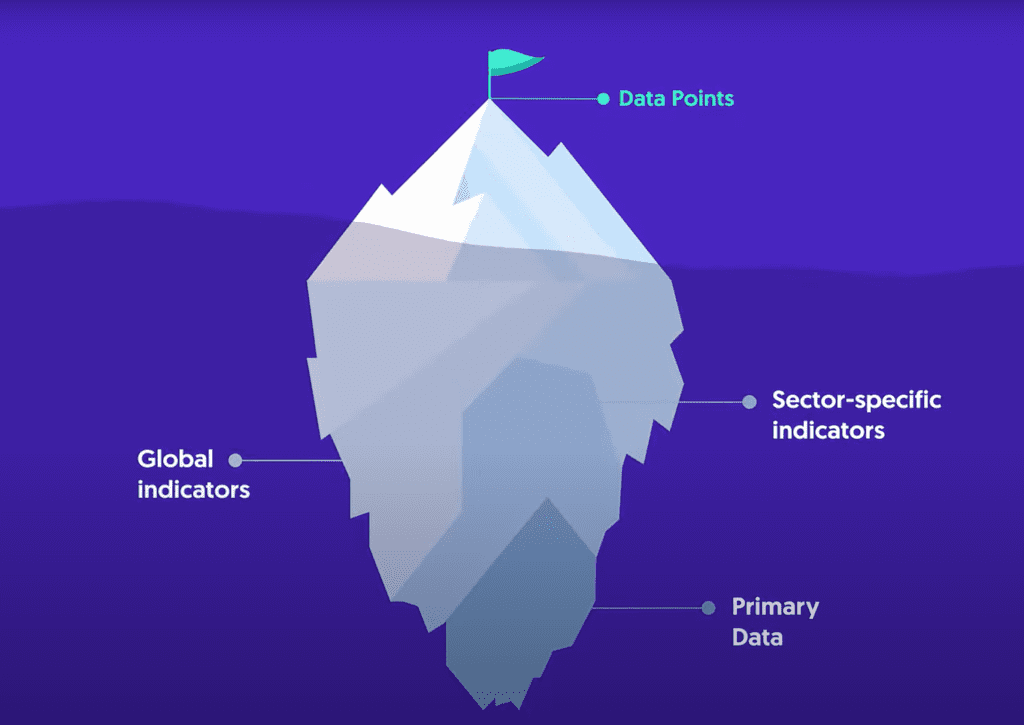

5. Not knowing what to report

Uncertainty around what data needs to be reported is another widespread problem. Many organisations struggle to determine which metrics are required to meet regulatory standards or stakeholder expectations. This can result in key information being omitted or a lack of focus on what truly matters.

6. A weak or incoherent narrative

This is one of the most significant and overlooked mistakes in ESG reporting. Simply presenting raw data isn’t enough – you need a clear, coherent narrative that demonstrates how the data aligns with the company’s sustainability goals. Too many organisations shy away from “negative” data, preferring to omit it entirely. However, there’s no such thing as bad data – only data that’s poorly explained. A weak narrative reduces transparency and casts doubt on the report’s authenticity.

7. Poor system integration

Using multiple systems or platforms to gather data can create major integration challenges. Consolidating data from different sources – ERPs, spreadsheets, management tools – can quickly become overwhelming without a suitable technological solution. Inefficient integration often leads to errors and inconsistencies in the final report.

8. Focusing on irrelevant topics

Another common pitfall is placing too much emphasis on irrelevant issues or producing shallow narratives that fail to address material topics. Whether intentional or not, leaving out key information reduces the report’s value and erodes trust among stakeholders.

9. Errors in data transcription

Manually transferring data between systems, documents, or platforms is prone to errors. Even a minor mistake during transcription can distort the information, impacting the accuracy of the final report.

10. Incomplete data

A lack of proper planning or an unclear understanding of what’s required often leads to incomplete data. Critical pieces of information can be missed entirely because they weren’t identified as relevant or because their collection wasn’t prioritised.

11. Inconsistent reporting periods

Presenting data from inconsistent time periods is another frequent mistake. When figures are pulled from different reporting timelines, it becomes difficult to compare them accurately, undermining the analysis. This often stems from poor coordination during data collection.

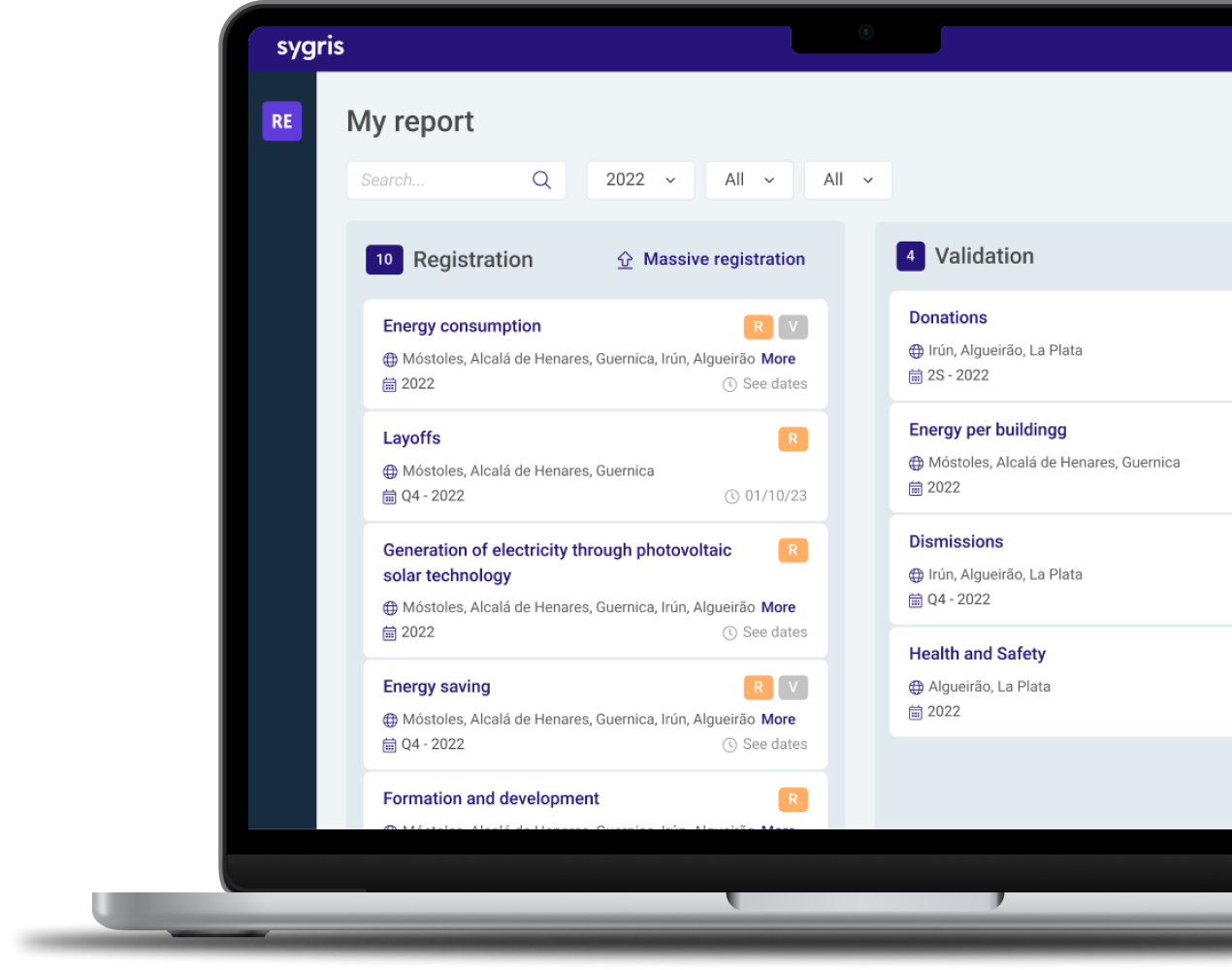

How to avoid these mistakes

The solution isn’t just about improving team coordination or implementing stricter processes. Tools like Sygris Reporting offer an efficient and reliable way to tackle the challenges of ESG reporting. By automating data collection, ensuring traceability, integrating multiple systems, and streamlining the creation of clear, coherent reports, Sygris helps organisations minimise errors and produce more robust, transparent reports.

If you want to avoid the most (and least) common pitfalls, and save time and resources in the process, adopting specialised tools is the key to delivering high-quality ESG reporting that meets regulatory demands and stakeholder expectations.